Finance Assets & Equipment with Driven Finance.

A consierge service for everyone.

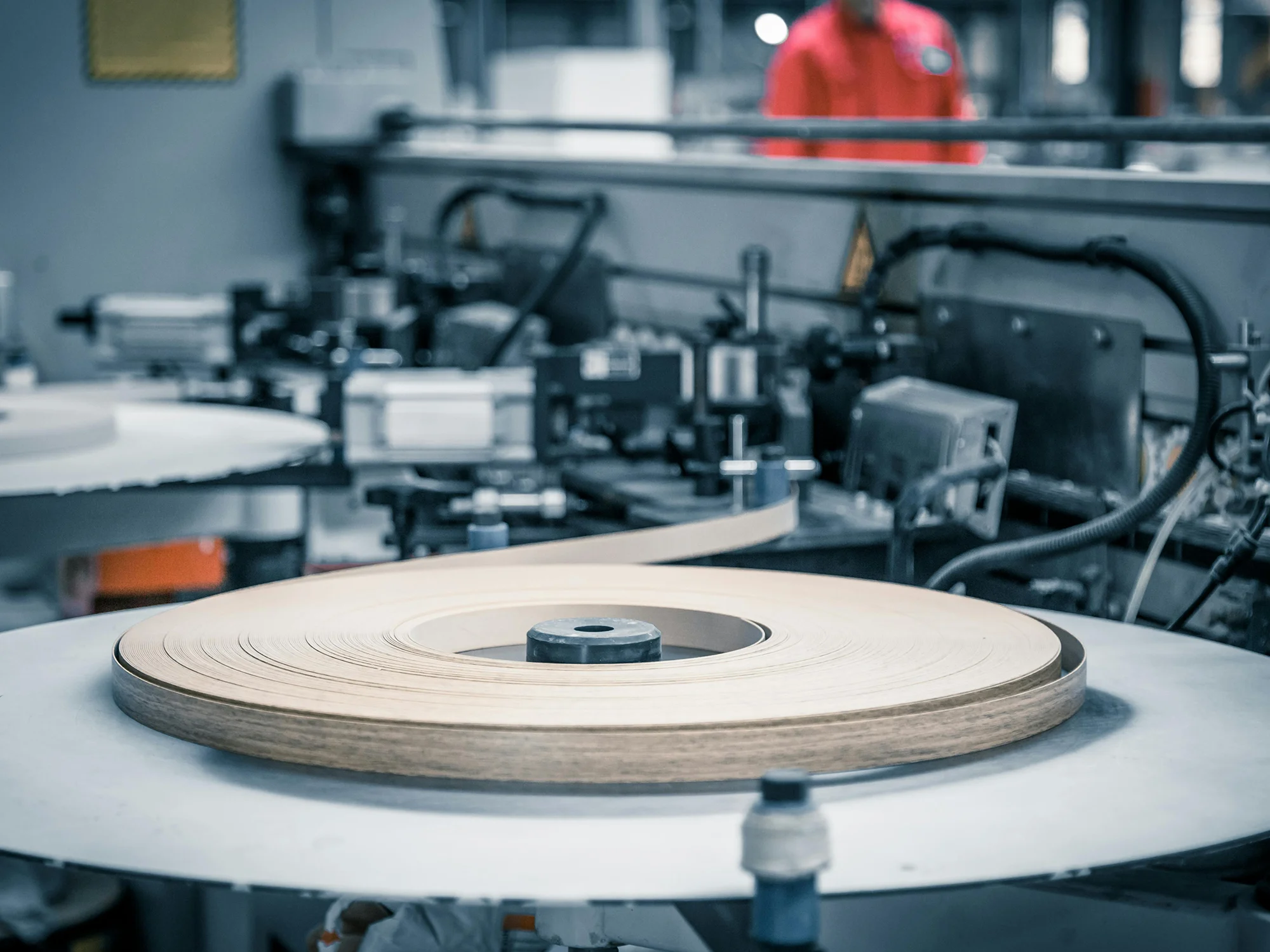

Asset Finance

Specialist finance for assets

Asset and equipment finance helps businesses acquire the machinery, vehicles, and equipment they need without the burden of large upfront costs. Instead of paying in full, the cost of the asset is spread over an agreed term through structured repayments, allowing you to preserve working capital and maintain healthy cash flow.

With options such as hire purchase and finance leases, asset finance gives you the flexibility to fund new or used equipment while matching repayments to your business needs. In many cases, the asset itself acts as security, making finance more accessible and helping you plan with confidence.

Asset finance can be used to support growth, replace outdated equipment, or improve operational efficiency across a wide range of industries. Once the agreement ends, you may own the asset outright, upgrade to newer equipment, or continue using it under a lease arrangement—depending on the finance solution chosen.

By aligning funding with the life of the asset, equipment finance offers a practical, cost-effective way to invest in your business while keeping cash available for day-to-day operations.

Get a Quick Quote

Use our asset finance calculator to determine the amount you can borrow for acquiring business or personal assets.

Calculations are indicative only and intended as a guide only. The figures calculated are not a statement of the actual repayments that will be charged on any actual loan and do not constitute a loan offer.

What can be financed?

Whats right for you?

Finance Options Compared

| Feature | Hire Purchase | Lease Purchase |

|---|---|---|

| Monthly Payments | Higher | Lower due to balloon payment |

| Final Payment | No balloon payment | Required balloon payment |

| Ownership | Yes, after final payment | Yes, after balloon payment |

| End-of-Term Options | Keep only | Keep only |

| Mileage Restrictions | No | No |

| Best For | Long-term ownership | High-value vehicles |

| Condition Requirements | No condition check | No condition check |

| Vehicle Age Suitability | New or used | New or used |